We are creative, ambitious and ready for challenges! Hire Us

We are creative, ambitious and ready for challenges! Hire Us

Over 10 years we help companies reach their financial and branding goals. Engitech is a values-driven technology agency dedicated.

411 University St, Seattle, USA

engitech@oceanthemes.net

+1 -800-456-478-23

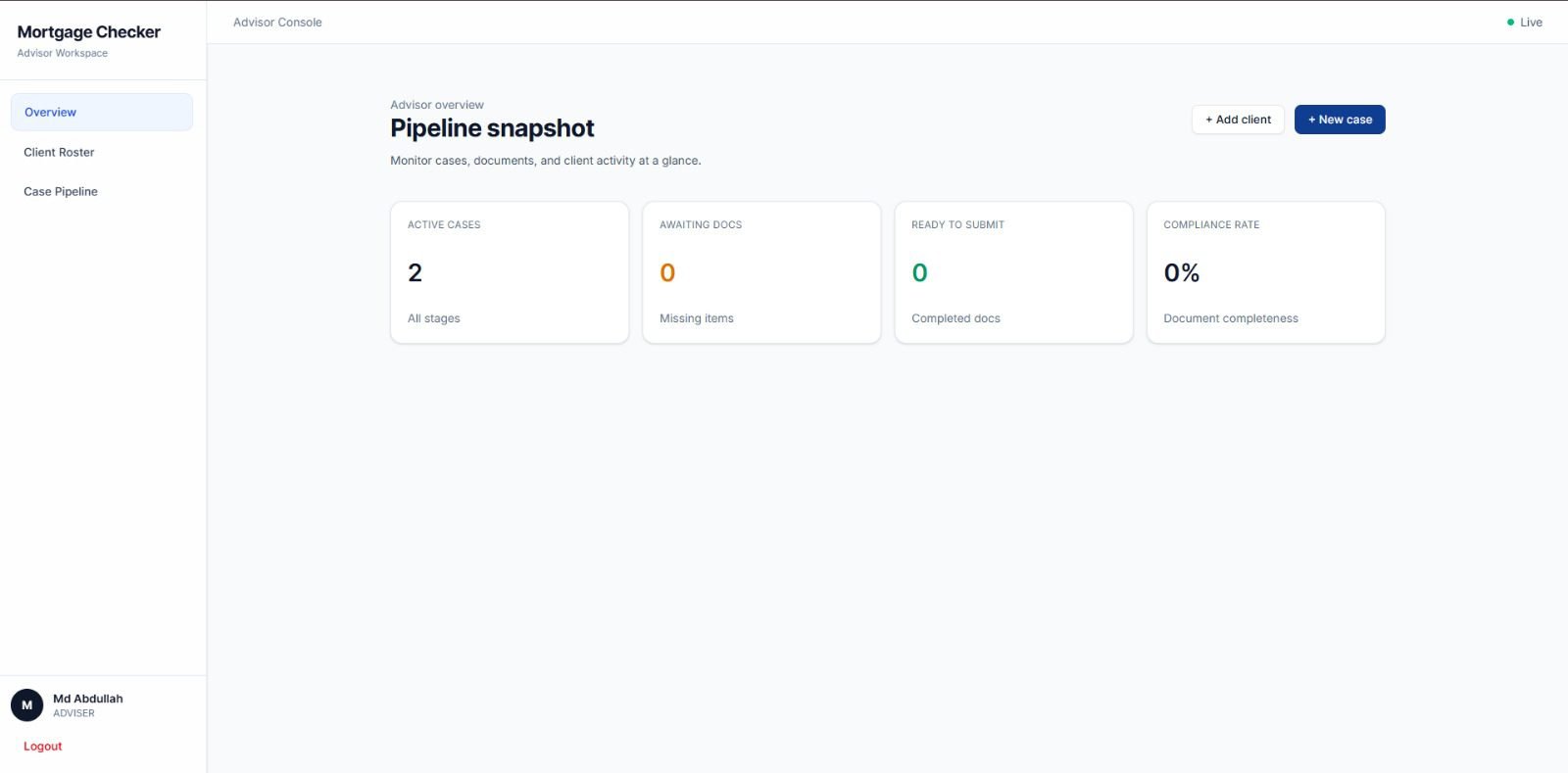

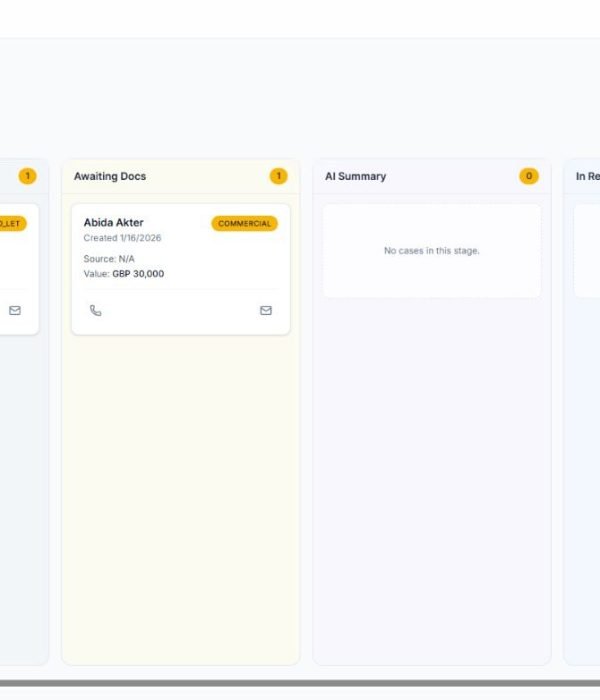

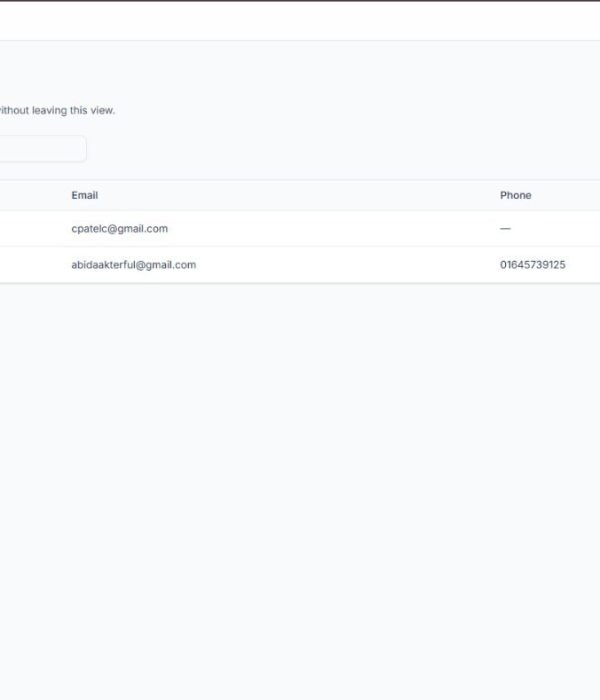

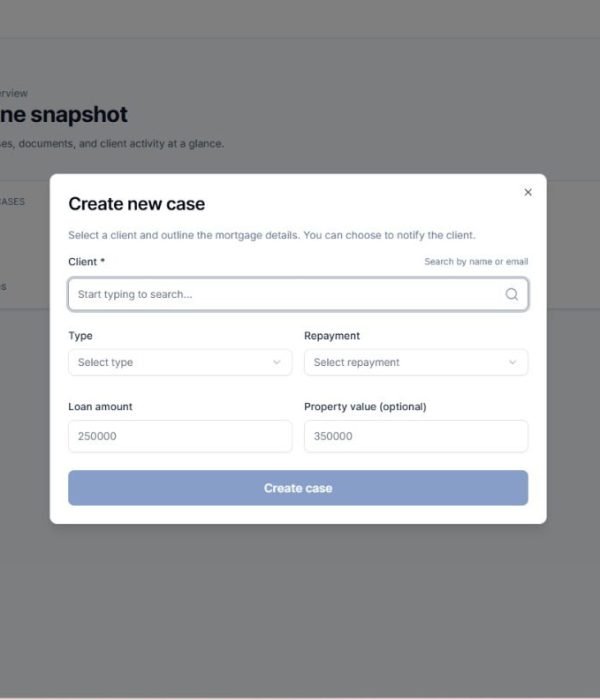

MortgageAI is an enterprise-grade, white-label platform that redefines regulatory compliance and operational efficiency for the UK mortgage sector. We have engineered a comprehensive AI-powered ecosystem that digitizes, automates, and governs the entire end-to-end mortgage advice process. The platform ingests the industry’s most stringent compliance frameworks—such as the detailed Bankhall Client File Checklist—and transforms them into a fully automated, intelligent workflow. From AI-driven document collection and validation to the execution of complex regulatory logic and seamless integration with core brokerage systems, MortgageAI provides a centralized command center for compliance, risk, and case management.

“In an industry built on trust and burdened by manual scrutiny, true innovation delivers not just automation, but actionable intelligence and unshakeable compliance confidence.”

This project was delivered through a phased, strategic partnership model designed for scalability and stringent regulatory adherence. Our process began with a deep collaborative analysis to map every compliance rule, advisory nuance, and operational touchpoint within our launch partner network. We then architected a modular, API-first platform, combining proprietary AI models for document intelligence with a robust rules engine capable of handling both hard regulations and nuanced advisory judgments. Critical to our strategy was the development of deep, two-way integrations with essential ecosystem platforms like GoHighLevel, ensuring seamless adoption and workflow unity. The platform was stress-tested in a controlled pilot with a major network, validating performance, accuracy, and operational fit before a structured market rollout.

The result is not merely a tool, but a foundational technology layer for modern mortgage firms. MortgageAI eliminates the critical pain points of manual fact-finding and file-checking, reducing process time from an industry-standard 4–12 hours to under 30 minutes per case. It delivers near-zero compliance errors, a fully inherent digital audit trail, and empowers networks to offer a branded, cutting-edge compliance system as a core competitive advantage. By deploying MortgageAI, firms are positioned at the forefront of the sector’s digital transformation, turning compliance from a cost center into a demonstrable pillar of efficiency, safety, and growth.